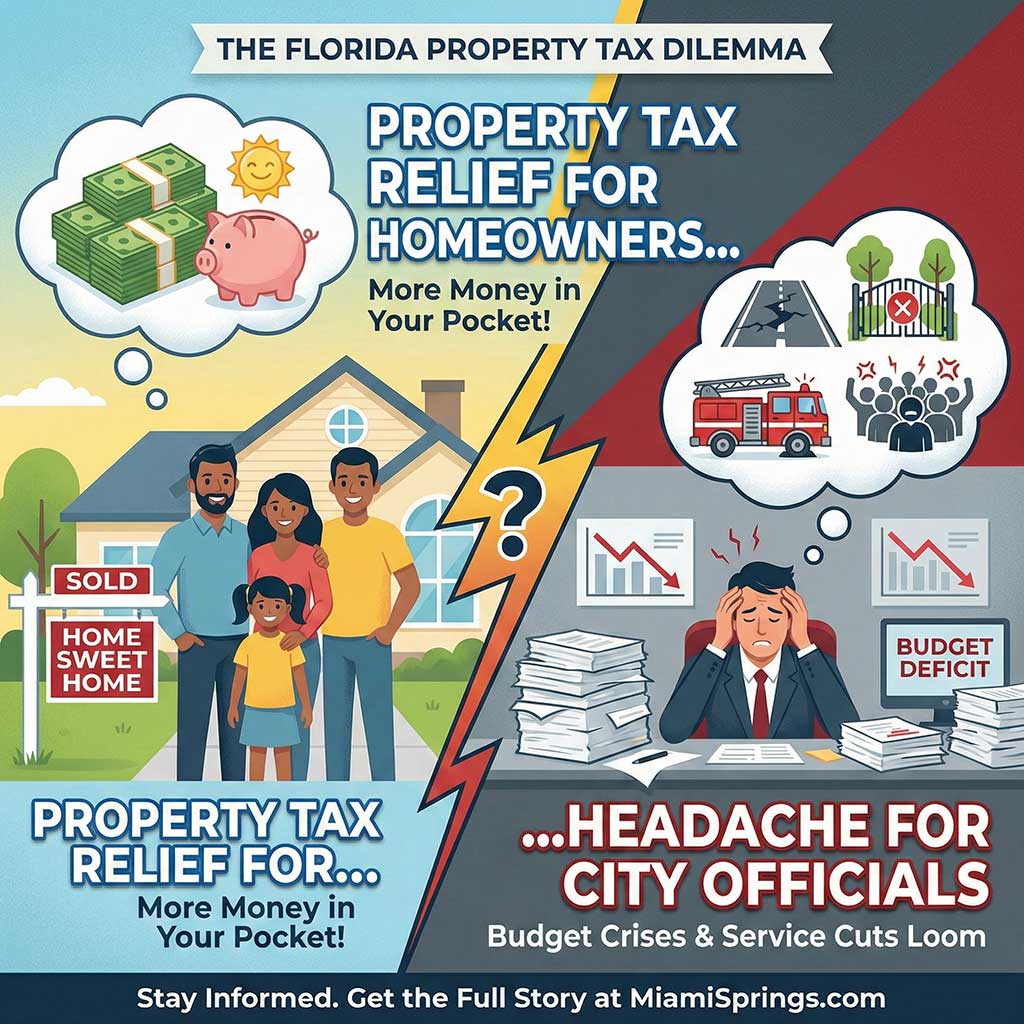

The landscape of Florida homeownership just shifted. On February 19, 2026, the Florida House passed HJR 203, a historic joint resolution aimed at eliminating a massive portion of property taxes for Florida homeowners.

While the prospect of “no property taxes” sounds like a dream for many, the reality of the bill is more nuanced—particularly for residents in tight-knit communities like Miami Springs and Virginia Gardens. Here is everything you need to know about how this plan works, what stays, and how it impacts our local services.

The 10-Year Fade: How the Phase-In Works

The House didn’t just flip a switch; the plan uses a “ramp-up” strategy to provide immediate relief while transitioning the state’s tax structure.

-

The Starting Line: Beginning January 1, 2027, the homestead exemption for non-school property taxes would increase by $100,000 every single year.

-

The “Wipeout” Effect: Because many homes in our area fall within a specific value bracket, most homeowners would see their non-school property taxes effectively vanish within the first 3 to 4 years.

-

Full Elimination: By the year 2037, the bill mandates that all homestead properties be 100% exempt from non-school ad valorem taxes.

The “Fine Print”: What Taxes Remain?

It is a common misconception that property tax bills will go to zero. They won’t. Here is the breakdown:

-

ELIMINATED: All “non-school” taxes. This is the money that currently funds city and county operations, local parks, libraries, and general infrastructure.

-

REMAINING: School District levies will stay exactly as they are. Since school taxes usually account for 30% to 50% of your total bill, you will still receive a tax bill—it will just be significantly lighter.

-

HOMESTEAD ONLY: This relief only applies to your primary residence. If you own rental property, a second home, or commercial real estate, your tax status remains unchanged.

Protecting Police and Fire

One of the biggest concerns during the House debate was how we would pay for emergency services. To address this, the bill includes a “Public Safety Backstop.”

The law would constitutionally prohibit local governments from funding law enforcement or fire departments below their 2024 or 2025 levels. However, critics point out a major flaw: while the dollar amount is protected, it doesn’t account for inflation or rising pension costs. In ten years, the same “2025 budget” might not buy the same amount of protection.

The “Springs” Perspective: Local Impact

For a “small-town” city like Miami Springs, which prides itself on its independent police force and beautiful green spaces, this bill is a double-edged sword.

-

Resident Savings: The average Springs homeowner stands to save between 40% and 60% on their annual tax bill. That’s thousands of dollars back into the pockets of local families.

-

The Budget Gap: Miami-Dade County is projected to lose over $2.3 billion in annual revenue. Locally, Miami Springs relies on these taxes to maintain our unique “small-town” feel. It could lose anywhere from 30 – 50% of its annual tax revenues.

-

Service Trade-offs: Because Police and Fire budgets are “protected,” other departments like Parks & Rec, the Golf Course, and Public Works (potholes and street lighting) may face the brunt of future budget cuts.

-

New Fees: To stay solvent, the City may have to look at alternative revenue streams, such as increased trash collection fees or new “user fees” for city facilities.

What Happens Next?

The bill now heads to the Florida Senate, where leadership has already expressed skepticism about the “aggressive” timeline. If the Senate passes a version of this bill, it will go to the voters in November 2026. As a constitutional amendment, it will require 60% approval from Florida voters to become law.

Stay tuned to MiamiSprings.com for updates as this legislation moves through Tallahassee.