The Miami-Dade County Board of County Commissioners did not vote on annexation for Miami Springs or Virginia Gardens during Wednesday’s nearly four hour long Chairman’s Council of Policy Meeting due to a lack of quorum.

Chairman Jose “Pepe” Diaz reshuffled the County Agenda items which pushed the annexation discussion to the end of the meeting. As the meeting continued, it was clear there was a risk of losing quorum as some of the County Commissioners had left and others had expressed that they would need to leave.

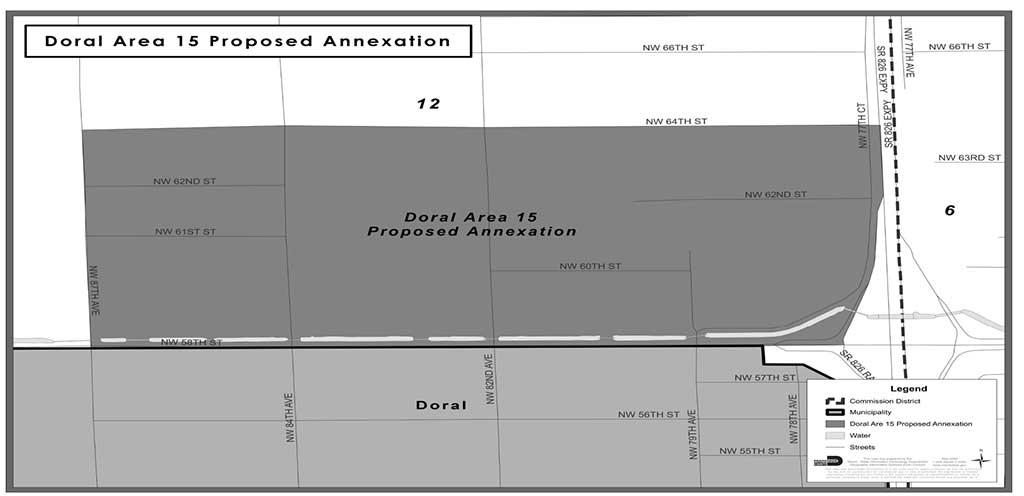

DORAL ANNEXATION

Nevertheless, the meeting finally got to the issue of annexation. The first city on the list was the City of Doral. During public discussion, the Deputy City Manager for the City of Doral stated they fully support the three applications for annexation. The Deputy City Manager brought up the investments the cities will have to incur in the annexation areas and stressed that the cities should not have to pay a mitigation fee.

Commissioner Rebeca Sosa stressed that if mitigation fees are applied, they would need to be applied to all the cities and not some yes and some no. Furthermore, it was expressed that if the cities did not lower their tax rates, that they could be forced to pay a mitigation fee.

The biggest concern is that property owners within the annexation areas are expected to see a massive tax increase. Put yourself in the position of a property owner along NW 72nd Avenue in unincorporated Miami-Dade County. The 2021 adopted millage rate in unincorporated Miami-Dade County is 1.9283. Miami Springs has a millage rate of 7.2095. That’s a potential 370% tax increase for these property owners. If I were in their shoes, I wouldn’t want a 370% tax increase either.

As expected, local property owners from the area to be annexed by the City of Doral expressed they were not interested in gaining additional services from the City of Doral and did not want to pay higher service fees and taxes. However, the opposition to the Doral annexation was not as strong or vocal as what came later against the Town of Medley.

Miami-Dade Commissioner Sally Heyman moved to approve the City of Doral’s application for annexation of the two parcels. Commissioner McGhee seconded the motion. The vote passed and now the Doral annexation will move to the Board of County Commissioner’s Meeting.

MITIGATION FEES

The County can’t force the municipalities to charge a specific tax rate, however, Commissioner Sosa asked the County Attorney to review a mitigation fee. As Commissioner Regalado mentioned, it could be a carrot and stick approach. If the municipalities lower their millage below a certain rate, the cities would not pay a mitigation fee. However, if the municipalities don’t lower the millage rates, the County would collect a mitigation fee. It was unclear if the mitigation fee would then be converted into a refund to the property owners who are seeing a potential skyrocketing of their property taxes.

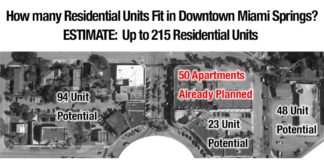

In other words, the City of Miami Springs initial revenue estimates for annexation may be completely off if the City of Miami Springs would have to lower the millage rates and potentially pay a mitigation fee.

If you put yourself in the position of the property owner’s in the area to be annexed, this makes total sense. What property owner wants to see a tax rate increase nearly 4 times as large as what they pay today?

VIRGINIA GARDENS

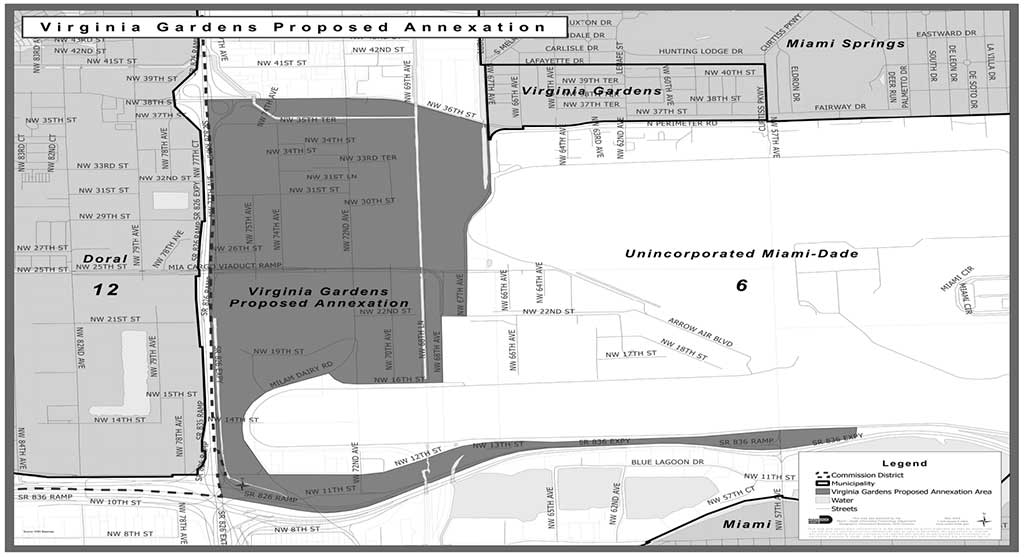

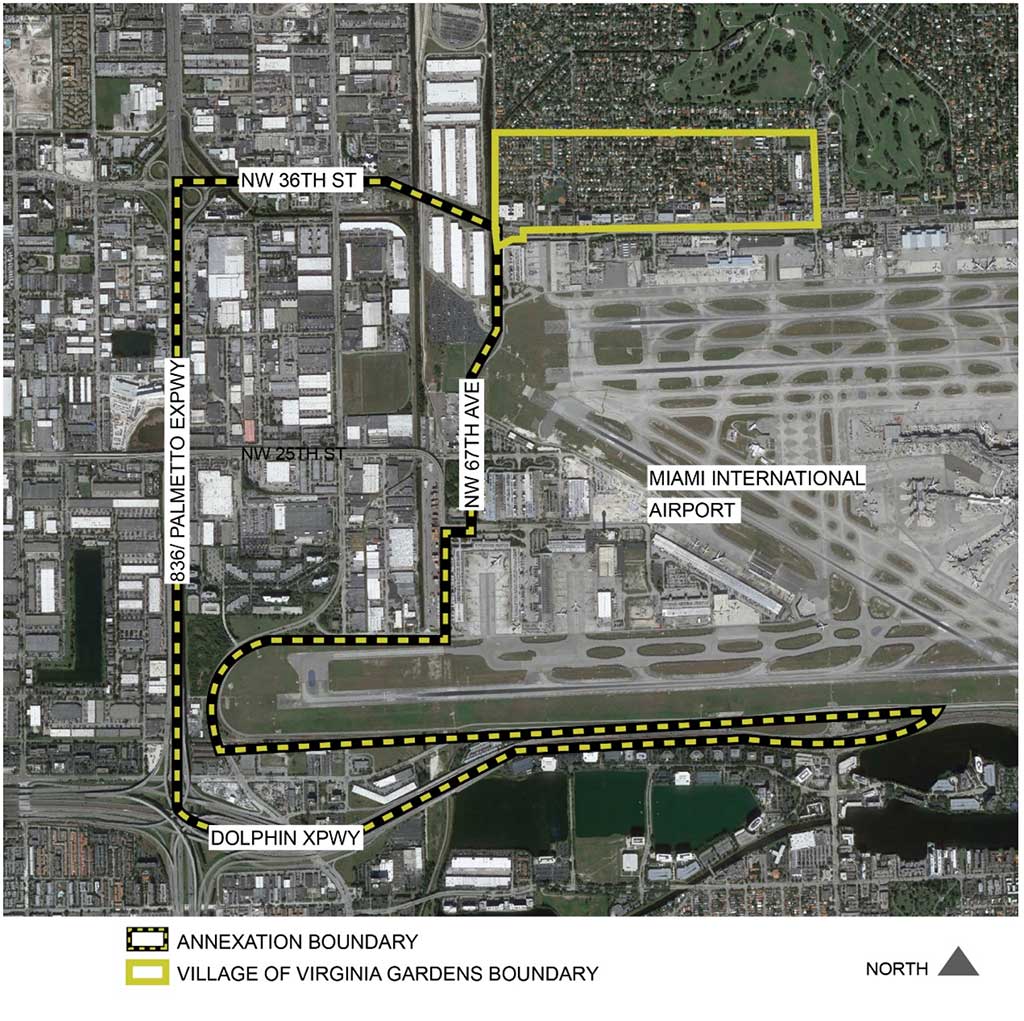

Despite not yet coming up on the agenda, Commissioner Rebeca Sosa brought up the Virginia Gardens annexation map and requested carving out the rail yard properties within the Virginia Gardens annexation area. That’s similar to the Miami Springs annexation map which does NOT include the newly created Amazon warehouses inside the railyard facility.

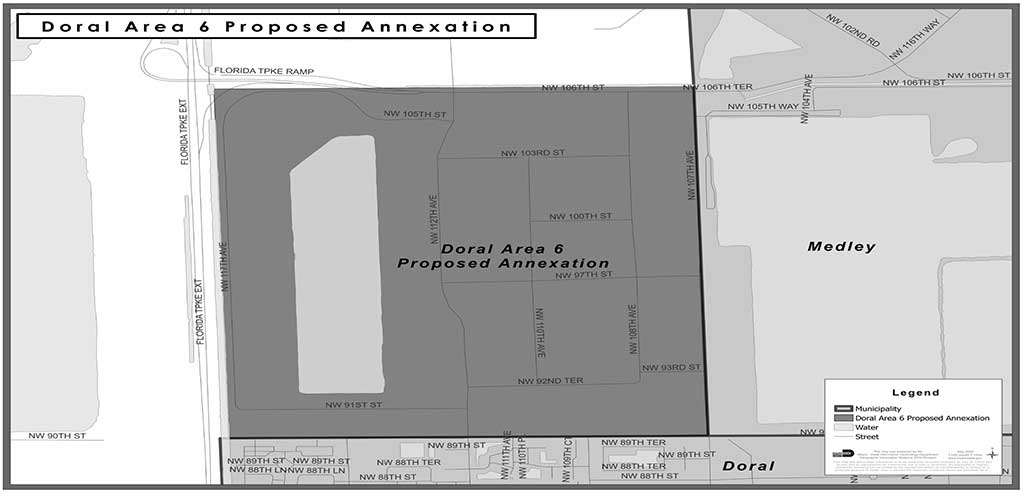

TOWN OF MEDLEY

After the County Committee approved the Doral application for annexation to move forward to the full County Commission, the Town of Medley came up. Roberto Martell brought up how Medley has dramatically lowered their tax rates with commitments to lower it further. For the record, Medley has a 2021 tax rate of 3.900 compared to the unincorporated tax rate of 1.9283.

Former Miami Lakes Mayor and current Town of Medley City Attorney, Michael Pizzi (who was acquitted of corruption in 2014) argued that the Town of Medley already provides many police services to their proposed annexation area. Pizzi argued that Medley already provides water pipelines that feed into the annexation area and service roads that support the annexation area.

Most of the objections to Medley’s annexation came from Titan America and many of its employees. The main objection from property owners is the obvious objection: the increased taxes for minimal if any gain in services by the annexation.

The County Commissioners discussed that they want a commitment from the municipalities in lowering millage rates.

Sally Heyman moved to approve the Medley application. Chairman Diaz seconded the motion. During the discussion, Commissioner Sosa walked out and the committee lost quorum. As a result, they could not proceed with the vote on the annexation for the Town of Medley nor proceed with Miami Springs or Virginia Gardens.

WHAT’S NEXT?

Commissioner Diaz wanted to push the vote for the Miami Springs Annexation and the VG Annexation to the next Board of County Commissioner’s Meeting or BCC Meeting. Commissioner Regalado expressed concerns over pushing the agenda items to the next BCC Meeting. Regalado stated “No one will be able to speak at the next BCC Meeting…It’s been impossible to get through this agenda.”

After losing quorum, Commissioner Diaz expressed that he would talk to the County Attorneys and talk to the representatives from each of the municipalities that did not get a decision on the application. He apologized and quickly closed the meeting.

A new Committee Meeting may be scheduled or it may still go to the next Board of County Commissioner’s Meeting. We’ll let you know once it’s scheduled.

READING THE TEA LEAVES

It seems clear to me, the County wants annexation to move forward, however, there’s a desire to limit the hit the businesses will take by the annexation. It looks like the County Attorney will work on some type of mitigation fee that will be assessed to each city based on the amount of millage rate over the current county millage rate. In other words, the County may allow the City’s to annex the desired areas, but then will have to pay a mitigation fee to the County that will then presumably be used to refund the property owners in the annexed areas in the form of a rebate or tax refund of some sort.

Will the mitigation fee be ongoing and everlasting or will it be temporary and sunset? It’s unclear. What does seem clear is that the tax windfall the city had projected in the past may not be as rosy depending on if and how much the mitigation fee will be.

The County Attorneys have some work to do to to craft the various areas of this mitigation fee. Furthermore, the City needs to do its part to attempt to minimize the mitigation fee and / or limit its tenure. In addition, the City needs to ensure it strengthens its arguments over the new benefits it will provide to these areas.

The City of Miami Springs will need to recalculate projected revenues minus the mitigation fees if the County puts it in place.

THOUGHTS / OPINIONS

If we step away and look at the overall fairness, it’s not fair for a property owner to get a nearly 400% increase in their taxes. I know none of us are happy about the doubling of our fuel costs over the last year. A mitigation fee may be the fair way to annex these areas and slowly sunsetting these properties away from the County Tax Rate and to the Municipal Tax Rate.

What do you think? Share your thoughts and feedback in the comments section below or via social media.

MEETING VIDEO

Below is the video of the Chairman’s Council of Policy Meeting held June 8, 2022.

I see the illustrious Miami Springs Council member Victor Vasquez taking a nap during the hearings. No doubt he is dreaming of the seat on the County Commission promised him by the Miami Dade County Democrats. Sleep well Victor and remember to resign soon.

We operate a business on 72nd Ave, I can tell you that not one of the business owners we have discussed this with, want this change… We pay 370% more in taxes…. and gain not one single benefit for all that extra money, nothing , zero, zip, zilch…. Now, to put it in perspective for those who do not know what that means for us. The taxes on our building jump from about $30,000 a year to almost $120,000 a year…. This change would cripple our business… in fact it will in all likelihood force us to close the doors on a business that has been here since 1980….

And make no mistake, This is all about Democrat elected officials, milking as much $$$ out of business owners in an industrial area as they can, they have mismanaged the money they already collect, they are broke and need to get creative to generate funds and hide their mismanagement… This will not stop until the people wise up and stop electing these type of people to run our city.

We DO NOT want MIAMI SPRINGS and it’s ridiculous tax rates

TYPICAL