The Miami Springs City Council voted unanimously to lower taxes for the upcoming fiscal year. The current millage rate in Miami Springs is 7.2095. The Council voted to set the cap or the highest rate for the next fiscal year at 6.9900. That’s a 3% lower tax rate than what we have today.

Tax Rates Can Go Lower

The millage cap sets the highest rate for next fiscal year, but it’s not final. That means that the the millage rate can still go lower, but it cannot go higher than the 6.9900 rate. In other words, we’re guaranteed a minimum of a 3% reduction in the millage rate for next fiscal year, but it may still go lower as the Council works through the upcoming budget workshops in August.

We appreciate the efforts of both this City Council and the City Administration in having the discipline to lower our tax rates.

May Still Pay More

Again, we applaud the efforts of the City Council and City Administration in doing their part to lower tax rates. However, that doesn’t necessarily mean your tax bill will be lower. Due to the increase in property values in South Florida and in Miami Springs, you’ll be paying a lower rate, but on the higher value of your home. Again, that’s still better than paying the same rate on a higher value or even worse, a higher rate on your increased property value. We just want to be sure people understand that while the tax rates are lower, your tax bill will still likely be higher this year do to the increase in property values.

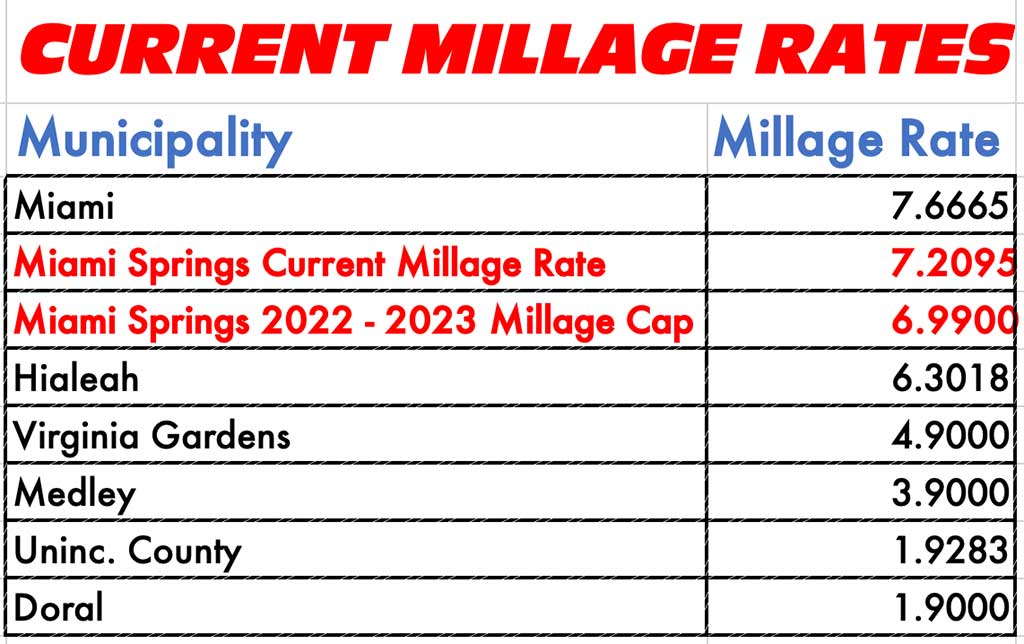

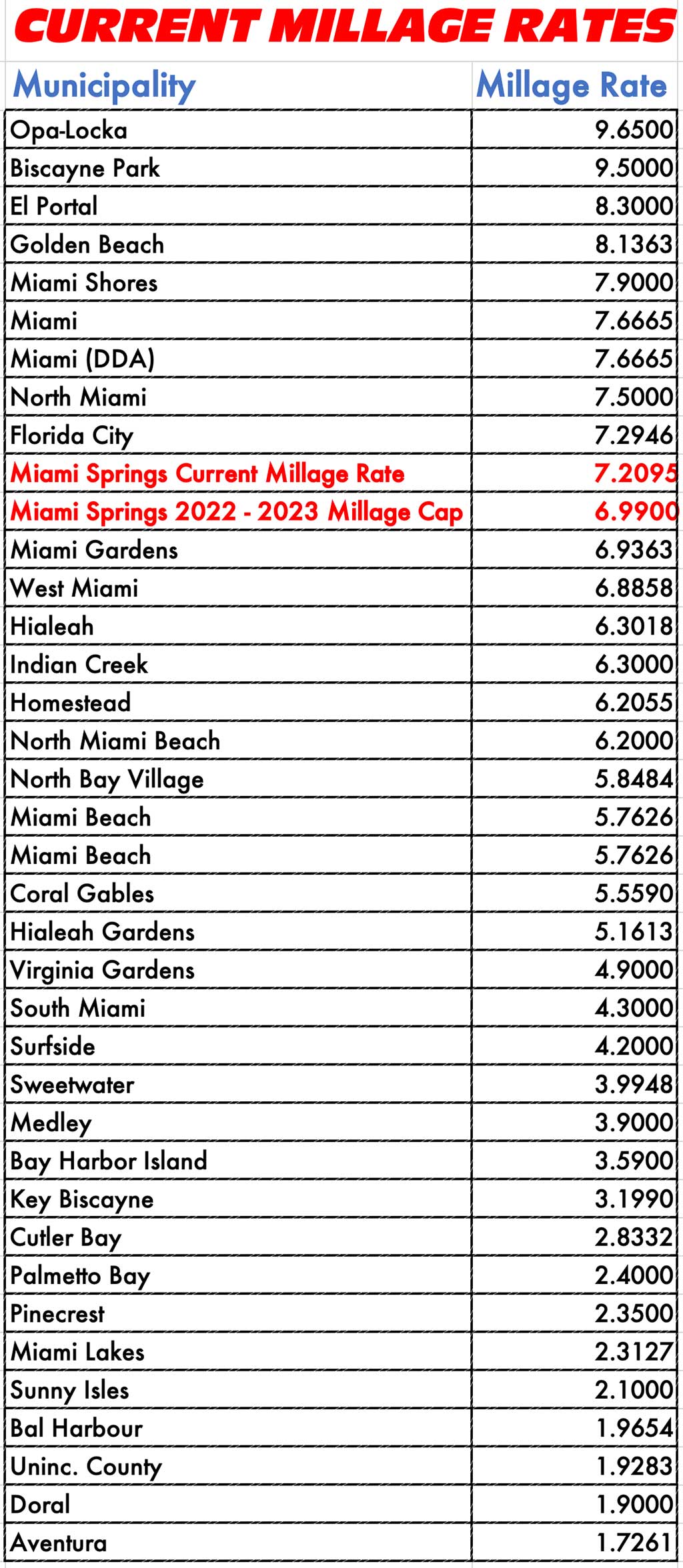

Miami Springs vs Other Municipalities

Again, we can’t stress enough that we’re very happy the City Council and City Administration have had the discipline to lower rates compared to the prior year. But it’s also important to compare the taxes we pay in Miami Springs versus the taxes paid by other municipalities. For example, Opa-Locka has the highest millage rate in the entire county at 9.6500. Doral has a millage rate of 1.9000. Miami Springs has the 10th highest millage rate in the County. Twenty-Six municipalities in Miami-Dade County have a lower millage rate than we do.

Miami Springs vs Neighboring Cities

We don’t think of the City of Miami too much as a geographical neighbor. That’s in part due to the quirky nature of the borders of the City of Miami. And the fact that there’s a sliver of Hialeah along NW 36th Street that separates Miami Springs from the City of Miami. The City of Miami’s millage rate stands at 7.665. It’s nice to have a millage rate that is significantly lower than our largest neighbor.

Our next biggest neighbor is our sister City to the north, Hialeah. They have a current millage rate of 6.3018 or nearly 10% lower than the 6.9900 Millage Cap in Miami Springs.

The Village of Virginia Gardens has a millage rate of 4.9000. That’s 30% lower than the Miami Springs Millage Cap rate of 6.9900.

The Town of Medley has a millage rate of 3.9000. That’s 44% lower than the cap rate for Miami Springs.

The Unincorporated area to our west. (The same area we’re attempting to annex.) falls under the Unincorporated Tax Rate of 1.9000. That’s 72% lower than the cap rate set by Miami Springs.

And finally, the City of Doral (which like the City of Miami has a small gap that separates us) has a millage rate of 1.7261. Their rate is 73% lower than the Miami Springs Cap Rate of 6.9900.

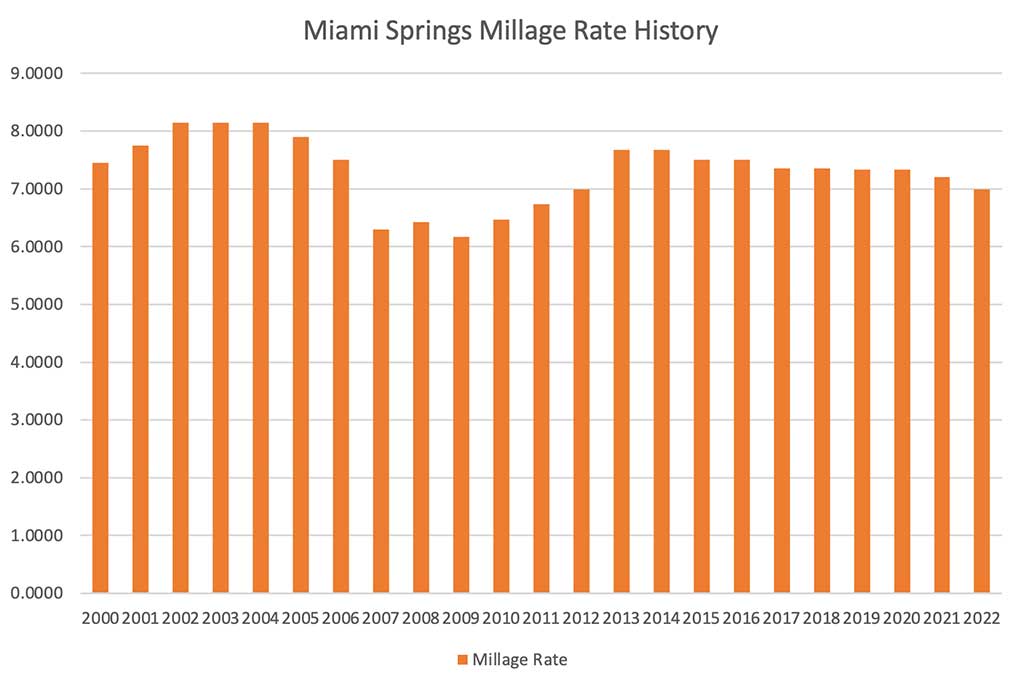

Miami Springs Millage Rate History

Below is a chart of the Miami Springs Millage Rate throughout this century. In the early 2000s the millage rate increased to over 8.0000. Taxes then bottomed out at 6.1698 in 2009. Then they slowly increased to 7.5000 in 2015. It has since been going down slowly and next year will be back below the 7.0 mark. The City of Miami Springs has also committed to lowering the millage rate if the annexation application is finally approved and the City successfully adds the significant tax base to the west of our city.