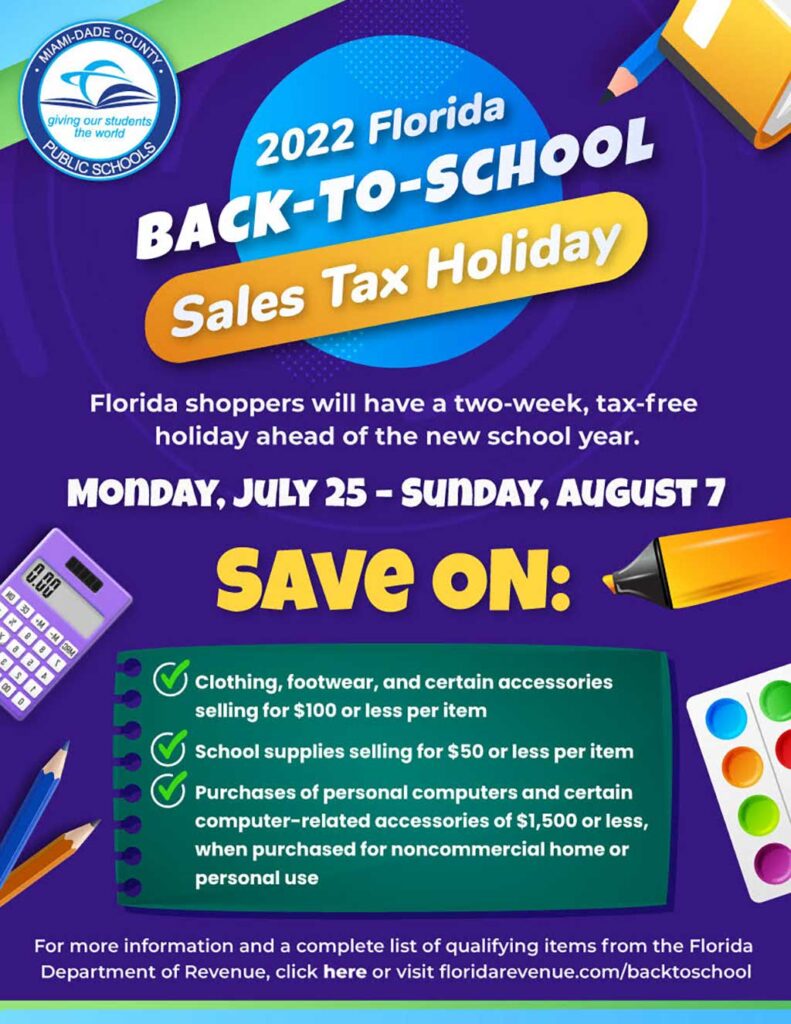

The Florida Back to School Sales Tax Holiday starts Monday, July 25th and runs through Sunday, August 7. This provides parents with a two week, tax-free holiday for the following items:

- Tax Free Items $1,500 or less:

- Personal Computers

- Computer Peripherals

- Computer Accessories

- Tax Free Items Under $100:

- Clothing

- Footwear

- Certain clothing accessories

- Tax Free Items Under $50:

- School supplies

- Tax Free Items Under $30:

- Learning aids and jigsaw puzzles

2022 Back-to-School Sales Tax Holiday – July 25, 2022 Through August 7, 2022

This sales tax holiday begins on Monday, July 25, 2022, and ends on Sunday, August 7, 2022.

During the sales tax holiday period, tax is not due on the retail sale of:

- Clothing, footwear, and certain accessories with a sales price of $100 or less per item*

- Certain school supplies with a sales price of $50 or less per item,

- Learning aids and jigsaw puzzles with a sales price of $30 or less*

- Personal computers and certain computer-related accessories with a sales price of $1,500 or less, when purchased for noncommercial home or personal use

This sales tax holiday does not apply to:

- Any item of clothing with a sales price of more than $100

- Any school supply item with a sales price of more than $50

- Books that are not otherwise exempt*

- Computers and computer-related accessories with a sales price of more than $1,500

- Computers and computer-related accessories purchased for commercial purposes

- Rentals of any eligible items

- Repairs or alterations of any eligible items

- Sales of any eligible items within a theme park, entertainment complex, public lodging establishment or airport

*Note: Overlapping Exemption Periods

The retail sale of children’s diapers and baby and toddler clothing, apparel, and footwear, regardless of the sales price, is exempt during the period July 1, 2022 through June 30, 2023. See TIP 22A01-06 for specific information about this tax exemption period.

The retail sale of children’s books (children ages 12 or younger), regardless of the sales price, is exempt during the period May 14, 2022 through August 14, 2022. See TIP 22A01-02 for specific information about this tax exemption period.