From the inception of the City of Miami Springs, it was designed to be a place that welcomed travelers from afar to paradise. Glenn Curtiss envisioned and created a grand hotel for its day. Unfortunately, the Hurricane of 1926 and the ensuing Great Depression put a pause on Glenn Curtiss’ great vision for Miami Springs.

Today, Miami Springs retains its place as a top destination for tens of thousands of travelers seeking lodging each year. Our proximity to Miami International Airport and our easy access to Miami Beach, Port of Miami, Wynwood, and downtown Miami makes Miami Springs a top choice for tourists.

Despite our small size of just three square miles and 14,000 residents, the City of Miami Springs has a huge number of hotels. Every night, we have hundreds, if not thousands of additional occupants sleeping in Miami Springs. Those temporary occupants also use City services no different than our tax paying residents. Whether it’s a police report for lost / stolen luggage at the hotel, or drunk and disorderly conduct, or the more serious incidents of human trafficking, drug trafficking, and assault, Miami Springs Police are responsible for handling all these calls. Unfortunately, you and I are the ones paying for these police calls.

As a result, the City of Miami Springs is pushing to get more revenues from the hotels to help pay for these services. There are basically two tactics:

- Get legislative approve for the City of Miami Springs to apply its own bed tax similar to Miami Beach

- Work with the County who collects the current bed tax so that the City of Miami Springs gets its fair share of these bed taxes

The City of Miami Springs gave a presentation at the Miami-Dade League of Cities meeting held last week to share our position with other municipalities regarding the current state of the Bed Tax also known as the Tourist Development Tax.

According to Florida state statutes, the Bed Tax can only be assessed by the Counties. in other words, municipalities cannot charge their own Bed Tax unless they already had a Bed Tax in place and are grandfathered in. The City of Miami Beach is a perfect example of this.

However, the City of Miami Springs has taken the position that cities should be entitled to a FAIR SHARE of the bed taxes collected in order to pay for police and other services the municipalities provide to these hotels. The city’s position is that paying for safety and reducing crime in tourists areas in and of itself helps to promote tourism. “Promoting tourism should include providing for their safety and wellbeing in the form of police service and many other services that your city provides to support the hotels.”

According to the presentation from the City of Miami Springs, Miami-Dade County collects Bed Tax revenues from every municipality within the County except for Surfside, Bal Harbour, and Miami Beach. Those three cities were grandfathered in before the state passed the current statute giving the authority to the county governments.

Who gets the Miami-Dade County Bed Tax Money?

According to the City of Miami Springs, the bulk of the Tourist Development Bed Tax revenues goes out to the following organizations:

- Greater Miami Convention and Visitors Bureau

- The Department of Cultural Affairs

- The Tourist Development Council

- The City of Miami

- The FTX Arena

- The Performing Arts Center

If you’re already puking, the City added that the vinyl covered Miami Marlins Stadium built for mega rich guys was partially paid for with the Tourist Development Bed Tax money. Of course, we know that those dollars were well spent since Marlins Stadium is among the top 25 reasons people fly in to visit Miami…NOT!

| MUNICIPALITY | BED TAXES | Share |

| Miami | $ 53,500,000 | 34% |

| Miami Beach | $ 39,300,000 | 25% |

| Unincorporated Miami-Dade | $ 16,300,000 | 10% |

| Doral | $ 9,200,000 | 6% |

| Sunny Isles Beach | $ 8,200,000 | 5% |

| Aventura | $ 6,200,000 | 4% |

| Coral Gables | $ 5,400,000 | 3% |

| Miami Springs | $ 3,800,000 | 2% |

| Key Biscayne | $ 3,500,000 | 2% |

| Hialeah | $ 2,200,000 | 1% |

| Homestead | $ 1,800,000 | 1% |

| Florida City | $ 1,400,000 | 1% |

| Miami Lakes | $ 1,400,000 | 1% |

| Miami Gardens | $ 938,000 | 1% |

| North Miami Beach | $ 796,000 | 0% |

| Sweetwater | $ 784,000 | 0% |

| North Miami | $ 776,000 | 0% |

| North Bay Village | $ 690,000 | 0% |

| Bay Hrbour Islands | $ 656,000 | 0% |

| South Miami | $ 644,000 | 0% |

| Hialeah Gardens | $ 500,000 | 0% |

| Palmetto Bay | $ 456,000 | 0% |

| Pinecrest | $ 360,000 | 0% |

| Virginia Gardens | $ 254,000 | 0% |

| Cutler Bay | $ 230,000 | 0% |

| West Miami | $ 75,000 | 0% |

| Medley | $ 47,000 | 0% |

| Miami Shores | $ 33,000 | 0% |

| El Portal | $ 22,000 | 0% |

| Opa-Locka | $ – | 0% |

| TOTAL REVENUE | $ 159,461,000 | 100% |

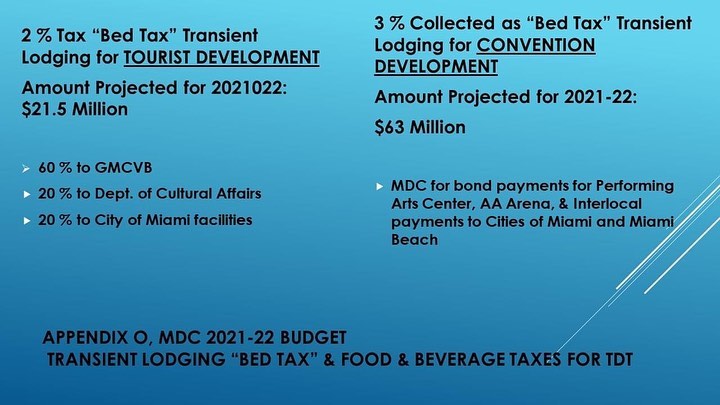

The City of Miami Springs presentation also included projections for the 2021 – 2022 fiscal year:

2% Tax “Bed Tax” for Tourist Development

| 2% Tax “Bed Tax” Transient Lodging for Tourist Development | ||

| Greater Miami Convention and Visitors Bureau | $ 12,900,000 | 60% |

| Department of Cultural Affairs | $ 4,300,000 | 20% |

| City of Miami Facilities | $ 4,300,000 | 20% |

| TOTAL | $ 21,500,000 | 100% |

3% “Bed Tax” for Convention Development

- Projected 2021-2022 Revenues: $63,000,000

- These dollars are spent by Miami-Dade County to pay for the Performing Arts Center in Miami, the FTX Arena, and interlocal payments to cities of Miami and Miami Beach

1% “Bed Tax” for Pro Sports Franchise

- Projected 2021 – 2022 revenues: $10.7 Million

- Pays for debt service on bonds to finance construction and renovation of professional sports franchise facilities

1% “Bed Tax” for Homeless and Domestic Violence

- Projected 2021 – 2022 revenues: $25.6 Million

- 85% for homeless programs, including when housing Miami-Dade homeless at the Miami Springs Red Roof Inn.

- 15% for domestic violence centers

We applaud the City’s efforts, especially those from Mayor Maria Mitchell who has steadfastly fought to rightfully collect a “Bed Tax” from these 36th Street Hotels that have become a drain on our Police resources.

We applaud the City’s efforts, especially those from Mayor Maria Mitchell who has steadfastly fought to rightfully collect a “Bed Tax” from these 36th Street Hotels that have become a drain on our Police resources.